The Trump Family's Crypto Venture: A Clear-Eyed Look at Politics and Digital Assets

When political power meets personal financial gain in the rapidly evolving world of cryptocurrency, the stakes couldn't be higher for American democracy.

The cryptocurrency industry has grown from a niche experiment to a trillion-dollar market that's reshaping global finance. But what happens when the family of the sitting president becomes deeply invested in this space? The Trump family's involvement in World Liberty Financial offers a case study in how modern conflicts of interest can emerge in ways our traditional ethics frameworks weren't designed to handle.

The Family Business Goes Digital

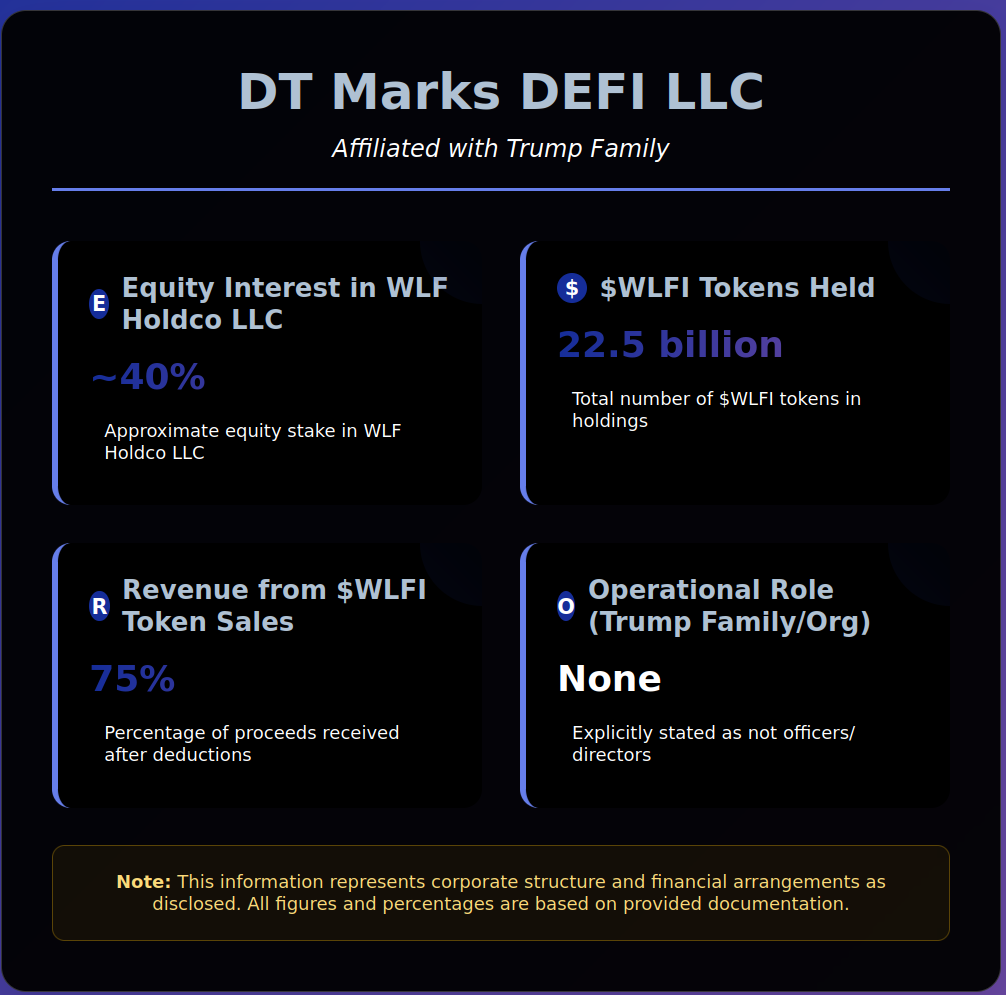

In 2024, the Trump family launched World Liberty Financial (WLF), a cryptocurrency venture that's far from a small side project. Through an entity called DT Marks DEFI LLC, the family holds approximately 40% equity in the company and controls 22.5 billion tokens of their own cryptocurrency. They're also entitled to 75% of proceeds from token sales.

The structure is carefully designed: while the Trump family reaps substantial financial benefits, they hold no official operational roles. This creates what ethics experts call "plausible deniability" – they profit significantly while maintaining distance from day-to-day operations.

The $2 Billion Deal That Raised Eyebrows

In May 2025, the family's cryptocurrency venture hit the big leagues. The Emirati investment firm MGX announced it would use World Liberty Financial's stablecoin (called USD1) to facilitate a $2 billion investment in Binance, one of the world's largest cryptocurrency exchanges. Donald Trump personally announced this deal at a crypto conference in Dubai.

The potential windfall for the Trump family? Up to $80 million annually if Binance holds onto the USD1 tokens, allowing World Liberty Financial to collect yield on the underlying reserves.

When Policy Meets Personal Profit

Here's where the story gets complicated. The Trump administration has simultaneously launched an aggressive pro-cryptocurrency agenda:

The FHFA Directive: In June 2025, the Federal Housing Finance Agency ordered Fannie Mae and Freddie Mac to accept cryptocurrencies as qualifying assets for mortgage loans. This eliminates the previous requirement for crypto holders to convert their digital assets to dollars before closing on a home loan.

The SEC's About-Face: After nearly two years of legal battles, the Securities and Exchange Commission dropped its lawsuit against Binance in May 2025. The exchange had faced 13 charges under the previous administration, including allegations of allowing U.S. traders illegal access and mishandling customer funds.

The Broader Context: The crypto industry spent over $130 million to elect pro-crypto candidates, and President Trump has declared his intention to make America the "crypto capital of the world."

The Transparency Problem

Unlike other major stablecoin issuers, World Liberty Financial hasn't published details about what backs their USD1 token. Tether, for comparison, publishes regular reserve reports (albeit with significant limitations). This lack of transparency creates what experts call a "regulatory dark zone" – users and regulators can't independently verify the stability or safety of the token.

What This Means for Democracy

Democratic lawmakers have been vocal in their criticism. Representative Maxine Waters calls it an effort by Republicans to "legitimize Trump and his family's efforts to enrich themselves." Senator Elizabeth Warren has directly labeled the situation "corruption."

Whether or not these accusations prove legally accurate, they point to a fundamental challenge: the appearance of impropriety can be just as damaging to democratic institutions as actual corruption.

The Bigger Picture

This isn't just about one family's business ventures. It's about how we maintain ethical governance in an era of rapid technological change. The cryptocurrency industry moves faster than traditional regulatory frameworks can adapt, creating gray areas where existing ethics rules may not clearly apply.

The timing of policy changes – crypto-friendly regulations followed by business deals that benefit the administration's family – creates what ethics experts call a "circumstantial link" that undermines public trust, even without proof of direct quid pro quo.

Looking Forward

The crypto industry represents genuine innovation with the potential to make financial services more accessible and efficient. The challenge lies in ensuring this innovation serves the public interest rather than private gain for those in power.

What's needed:

Stronger disclosure requirements for public officials' digital asset holdings

Clearer recusal rules for policy decisions affecting personal financial interests

Independent oversight bodies with specific expertise in digital assets

Transparent reserve reporting for stablecoins, especially those with political connections

The Optimistic View

Despite these challenges, there's reason for hope. The intense scrutiny this situation has received shows that our democratic institutions, while imperfect, are still capable of self-correction. Public awareness of these issues is the first step toward addressing them.

The cryptocurrency industry's potential to democratize finance, increase financial inclusion, and drive innovation remains real. The question is whether we can harness these benefits while maintaining the ethical foundations that make such innovation possible in the first place.

American democracy has weathered many storms by adapting its institutions to new challenges. The intersection of digital assets and political power is just the latest test – one that requires vigilance, transparency, and a commitment to putting public interest above private gain.

The future of both cryptocurrency and democratic governance may depend on how well we navigate this balance.

Lessons Learned and Future Implications

Key Lessons on Governance, Transparency, and Accountability in Digital Assets

The events underscore the critical need for robust and proactive regulatory frameworks for emerging financial technologies, especially stablecoins, to prevent conflicts of interest and ensure market integrity. Transparency in reserve holdings is paramount for stablecoins to maintain trust and stability, particularly for those with high-profile affiliations.1

The events highlight a fundamental tension between fostering innovation in a new industry and upholding traditional ethical standards for public officials. Without clear boundaries, the "Wild West" nature of the crypto industry can easily become a breeding ground for perceived or actual ethical breaches. The case demonstrates how rapidly evolving industries like crypto can outpace existing ethical and regulatory frameworks. The Trump family's direct financial interests intersect with the administration's policy changes, creating a clear conflict of interest. Traditional ethical laws and norms, designed for conventional industries, may not adequately address the unique complexities of digital assets, such as token ownership, decentralized finance, or the global nature of crypto transactions. This creates loopholes or ambiguities that can be exploited. This tension necessitates a re-evaluation of ethical laws for public officials to specifically address digital asset holdings and their potential for conflicts of interest. Without such updates, the "ethics crisis" is likely to persist and deepen as more influential individuals enter the crypto space, undermining public trust and potentially leading to market instability if underlying financial risks are not transparently managed.

Recommendations for Mitigating Future Ethical Risks

To mitigate future ethical risks, several measures are recommended:

Stronger Disclosure Requirements: Public officials should be subject to more stringent disclosure requirements for digital asset holdings and affiliations. This should include detailed information on ownership structures, revenue shares, and any agreements with crypto companies.

Stricter Recusal Rules: Officials involved in policymaking that could directly or indirectly benefit their personal or family's financial interests in emerging sectors should be subject to stricter recusal rules. This ensures that decisions are made in the public interest, not for private gain.

Independent Oversight Bodies: The establishment of independent oversight bodies with specific expertise in digital assets is crucial to ensure impartial regulation. These bodies should have the authority to scrutinize transparency, conflicts of interest, and adherence to ethical standards.

Broader Outlook for Crypto Regulation and Political Engagement

The ongoing political polarization surrounding crypto regulation and the potential for it to become a partisan issue, as evidenced by the reactions of Democratic lawmakers, is a concerning trend.1 The Trump administration's vision to make the U.S. a "crypto capital" 1 could, if not managed with robust ethical frameworks, lead to a situation where innovation is prioritized at the expense of integrity.

The crypto industry's significant lobbying and campaign donations 1 underscore the need to carefully monitor how political contributions influence policymaking. The future of U.S. leadership in digital assets will depend on whether it is driven by sound innovation and a fair marketplace, or by perceived ethical compromises that undermine public trust.

Conclusion

The convergence of the Trump family's significant financial interests in World Liberty Financial and USD1, combined with the Trump administration's aggressive pro-crypto policy agenda, creates a compelling case for an "ethics crisis." The $2 billion MGX-Binance deal, facilitated by USD1, and the timing of the SEC's regulatory leniency towards Binance, exemplify the potential for political influence to be translated into personal financial gain.

This situation underscores the urgent need for increased transparency, robust ethical frameworks, and vigilant oversight to safeguard regulatory integrity and public trust in the rapidly evolving digital asset landscape. Without such measures, the financial system risks exposure to hidden dangers and an erosion of the ethical principles fundamental to a fair and functioning economy.

Footnotes

Bias Examination:

Summary: This report acknowledges potential biases in the source material, particularly in the Fortune Crypto articles. While these articles report factual events, their framing, language, and emphasis may lean towards a critical or suspicious interpretation of the Trump family's crypto activities. For instance, terms like "entanglements" 1 and direct quotes from Democratic lawmakers accusing "corruption" 1 are prominently featured without immediate counter-framing from the Trump family's side. The focus on "profit" and "opacity" 1 also sets a specific tone. The article "Marc Andreessen gave an AI agent $50,000 of bitcoin — it endorsed GOAT" 1 serves as a general example of how misinformation and sensationalism can spread within the crypto space, highlighting the need for critical analysis of all narratives.

Explanation of Identified Biases: The primary bias identified is a critical or skeptical framing of the Trump family's financial activities in crypto, often highlighting potential conflicts of interest and lack of transparency. This is evident through:

Loaded Language: The use of terms like "entanglements" 1 and direct quotes from critics using words like "corruption" 1 can predispose the reader to a negative view.

Emphasis on Conflict: The articles prioritize the narrative of political influence leading to personal gain, dedicating significant space to Democratic opposition and the "opacity" of deals.1

Limited Counter-Perspective: While it is noted that Binance and WLF declined to comment 1, the absence of a robust defense or an alternative interpretation from the Trump family or their businesses can create a one-sided narrative.

Is this biased? How is this biased?: Yes, the Fortune Crypto articles exhibit a degree of bias through their framing and emphasis, leaning towards a critical stance on the ethical implications of the Trump family's crypto dealings. This bias is primarily editorial/framing bias, where the selection and presentation of information, rather than direct falsehoods, shape the reader's perception. The report itself aims to present these facts and criticisms objectively, acknowledging the sources' perspectives while drawing independent conclusions.

Mistake Examination:

Summary: The analysis identified no direct factual mistakes within the provided pieces of information that would invalidate the central claims. However, the nature of certain "audits" within the crypto space (e.g., Tether's "reasonable assurance engagement" 1) is often misunderstood as a full financial audit, which it is not. The "fake news story" about the AI agent endorsing GOAT 1 serves as a reminder of the prevalence of misinformation and hype within the crypto sector, necessitating careful fact-checking.

Explanation of Identified Mistakes (or potential for misinterpretation):

Misinterpretation of "Audit" Scope: Tether's report 1 is a "reasonable assurance engagement" under ISAE 3000 Revised, not a full financial audit. It has explicit limitations: it is a snapshot, does not assure management's going concern assessment, values assets under "normal trading conditions" (not stress), and excludes the "Notes" from the scope of assurance. This is not a "mistake" by the auditor, but a common misinterpretation by the public or media. For World Liberty Financial, the "mistake" is the

absence of even this limited level of public assurance, creating a significant transparency deficit.Misinformation in Crypto Narratives: The story of the "AI agent endorsing GOAT" 1 is explicitly identified as a "sensational fake news story" that went viral because it "confirmed every hope and fear of crypto-anarchists... and memecoin traders." This example highlights the crypto community's susceptibility to narratives that align with their biases, often leading to "relegated fact-checking".1 This is not a mistake in the report's analysis, but a crucial contextual point about the broader crypto environment where ethical concerns and financial schemes can thrive under a veil of hype and unverified claims.

Does this contain any mistakes? How do we understand any/every potential/possible mistake?: The provided source material appears to be factually reported within its own context. The potential "mistakes" lie more in the broader public or media interpretation of crypto-related financial disclosures (e.g., assuming a limited assurance report is a full audit) and the crypto space's inherent susceptibility to misinformation. Understanding these potential misinterpretations and the hype environment is crucial for a comprehensive ethical analysis.

//Peace

Sources

https://www.rawstory.com/raw-investigates/trump-qatar-plane-2672031382/

https://worldlibertyfinancial.com/

https://www.coingecko.com/en/coins/usd1-wlfi/historical_data

https://news.bitcoin.com/bitcoins-top-mining-pool-foundry-usas-hashrate-climbed-350-in-12-months/

https://fortune.com/crypto/2025/06/29/bitcoin-digital-assets-irs-tax-letters-coinledger/

https://fortune.com/crypto/section/regulators/

https://fortune.com/crypto/2023/02/13/binance-stablecoin-peril-regulators-force-paxos-stop-busd/

https://mempool.space/docs/faq

https://protos.com/marc-andreessen-gave-an-ai-agent-50000-of-bitcoin-it-endorsed-goat/

The Imperial Presidency: How to Turn Public Service into a Personal Piggy Bank (A Masterclass in Modern Monarchy)

Introduction: Welcome to the Influence Market

The American Corruption Machine: A Beginner's Guide to Getting Fleeced

Remember when your biggest worry was whether politicians were lying about their campaign promises?

How global power works. The flow of money, tech, and diplomacy matters

The Quiet Deals Beneath the Rubble: How Israel’s War Is Funded from the Gulf

The $2.7 Billion Golf Cart: A Taxpayer's Guide to Presidential Waste, Fraud & Abuse

The TL;DR for Busy Taxpayers Who Just Want to Know How Much They Got Fleeced